Tax Rules help Marello find the correct tax rate that should be used for the products included in orders. This is done by matching three tax entities to create a Tax Rule: Tax Codes, Tax Rates

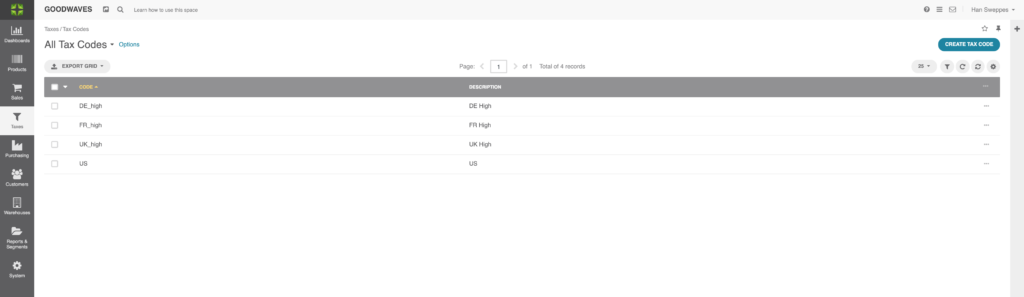

Tax Codes Overview

A label for a group that follows similar taxation rules in at least one tax jurisdiction. In Marello, this usually means codes for countries.

- Navigate to taxes -> Tax Codes

You will now see an overview of all tax codes, including:

- Code: A recognizable code

- Description: Description of the code

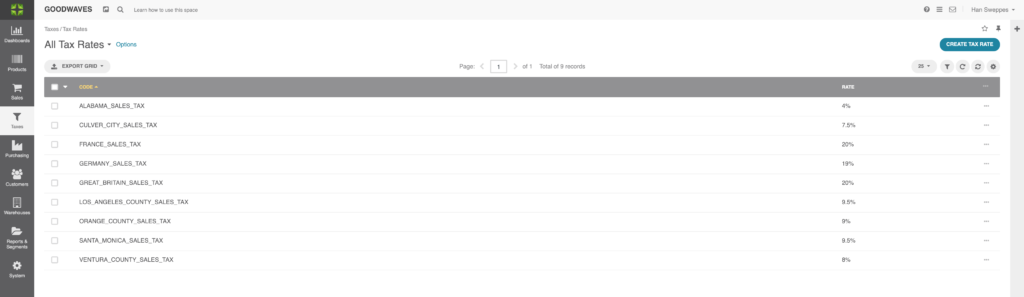

Tax Rates Overview

The percentage that should be paid as a tax in the particular tax jurisdiction for a certain type of products sold to a group of customers with the same tax status.

- Navigate to taxes -> Tax Rates

You will now see an overview of all tax rates, including:

- Code: A code that clarifies the area the tax rate is for

- Rate: A rate that corresponds with a certain area

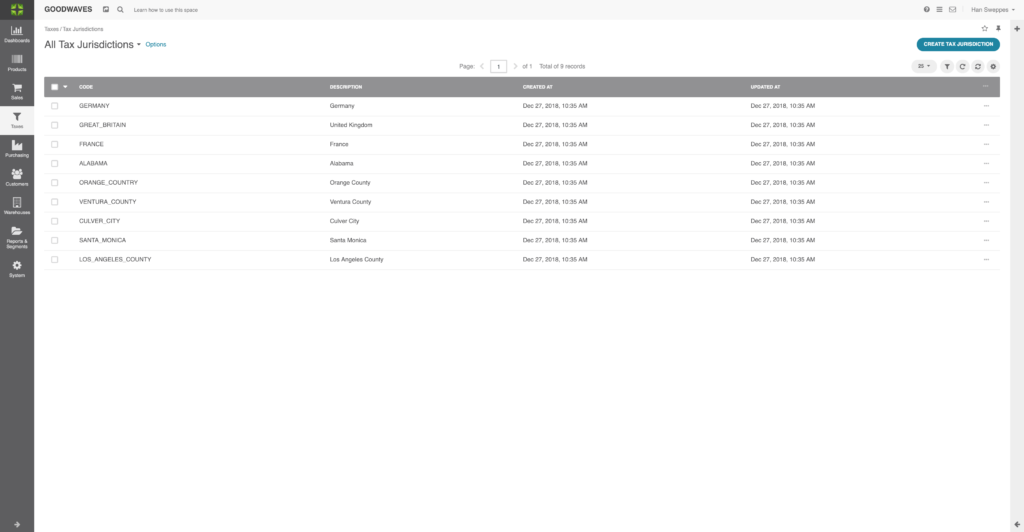

Tax Jurisdiction Overview

A Tax Jurisdiction is an address, usually a state in a country that has defined taxation policies that determine when and how the company should pay their sales or VAT tax, and what rates should be used, depending on the tax status of the products you sell and the parties you sell to.

- Navigate to taxes -> Tax Jurisdictions

You will now see an overview of all tax jurisdictions, including:

- Code: A code that defines the jurisdiction

- Desciption: A description that defines the jurisdiction

- Created at: When the tax jurisdiction was created

- Updated at: When the tax jurisdiction was last updated

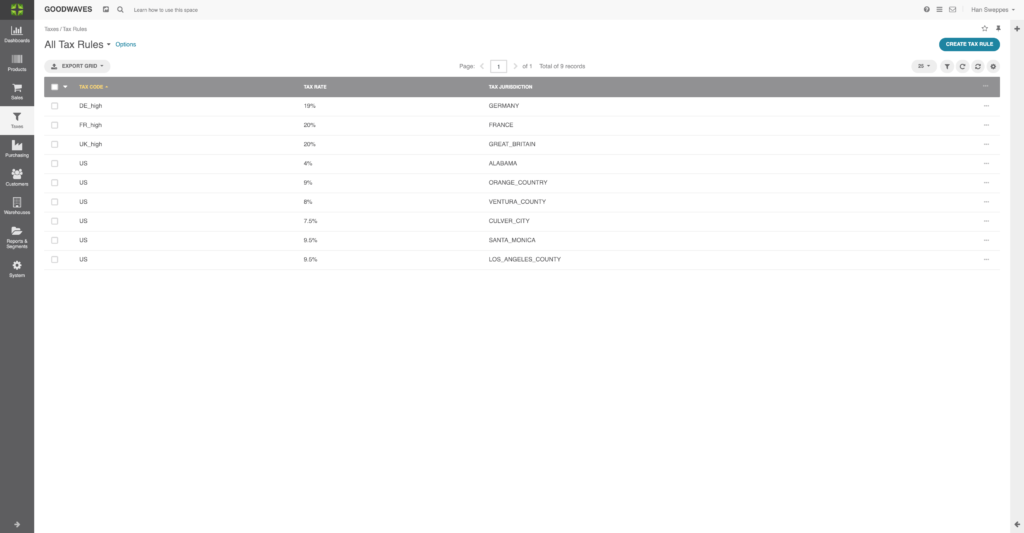

Tax Rule Overview

A tax rule combines the tax codes, tax rates

- Navigate to Taxes -> Tax Rules

You will now see an overview of all Tax Rules, including:

- Tax Code: A tax code, defining a country

- Tax Rate: A tax rate, corresponding to tax

legislations - Tax Jurisdiction: A state or country that has defined taxation policies

Working with Tax Rules Codes, Rates and Jurisdictions

Tax rules help Marello find the correct tax rate that should be used for the products included in orders. This is done by matching three tax entities to create a Rax Rule.

In Marello, a Tax Rule binds the following items:

- tax code – a label for a group of products that have similar taxation rules in at least one tax jurisdiction.

- tax rate – the percentage that should be paid as a tax in the particular tax jurisdiction.

- tax jurisdiction – an address, usually a state in a country that has defined taxation policies that determine when and how the company should pay their sales or VAT tax, and what rates should be used, depending on the tax status of the products you sell and the parties you sell to.

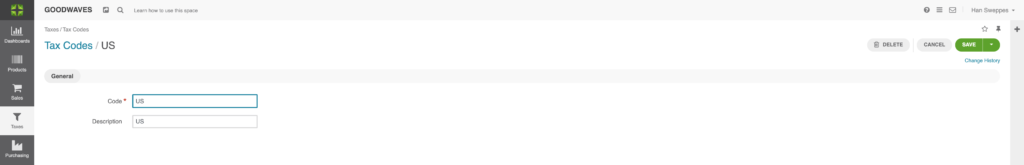

Step one: Creating Tax Codes

A Tax Code is a label for a group of products that have similar taxation rules in at least one tax jurisdiction.

In this Example we’ll create a tax code for the United States.

- Navigate to Taxes -> Tax Codes

- Click on the ”Create Tax Code” Button

- Fill in the following fields:

- Code: A code by which the code can be recognized, in this

case US forUnited States - Description: A description

for the Tax Code

3. Click ”save and close”

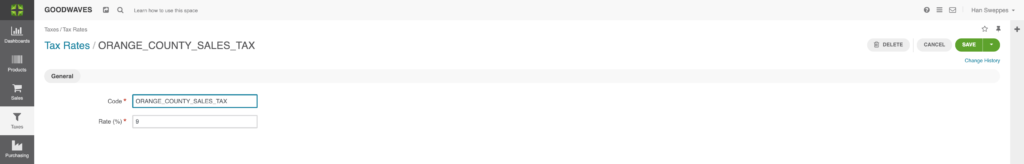

Step two: Creating Tax Rates

A tax rate is a percentage that should be paid as a tax in the particular tax jurisdiction.

In this example, we’ll create a tax rate for Orange County

- Navigate to Taxes -> Tax Rates

- Click on the ”Create Tax Rates” button

- Fill in the following fields:

- Code: A code that defines a certain jurisdiction to which rate applies.

- Rate: The tax rate that applies to the jurisdiction.

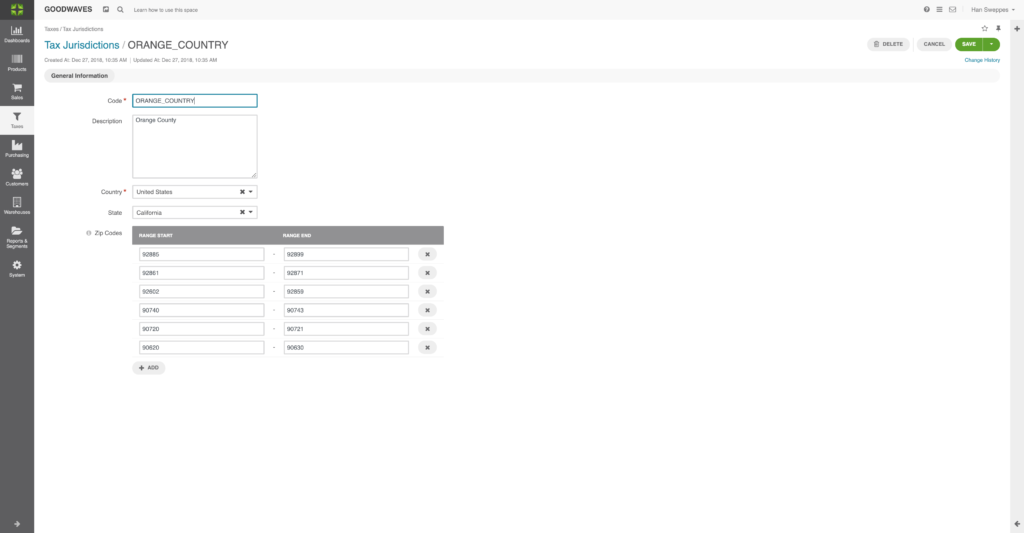

Step three: Creating Tax Jurisdictions

A Tax Jurisdiction is an address, usually a state in a country that has defined taxation policies that determine when and how the company should pay their sales or VAT tax, and what rates should be used, depending on the tax status of the products you sell and the parties you sell to.

In this example, we’ll set up the Tax Jurisdiction for Orange Country.

- Navigate to Taxes -> Tax Jurisdictions

- Click the ”Create Tax Jurisdiction” button

- Fill in the following fields:

- Code: A code by which the Tax Jurisdiction can be recognized

- Description: A description by which the Tax Jurisdiction can be recognized

- Country: The country the Tax Jurisdiction is created for

- State: The state the Tax Jurisdiction is created for

- Zip Codes: The zip codes that correspond with the defined Jurisdiction.

This means that in this case, all zipcodes that occur in Orange County should be added.

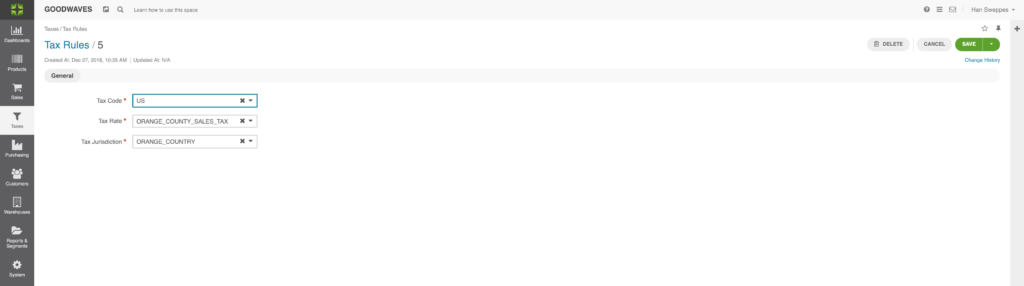

Step four: Creating Tax Rules

Tax Rules help Marello find the correct tax rate that should be used for the products included in orders. This is done by matching three tax entities to create a Tax Rule: Tax Codes, Tax Rates, and Tax Jurisdictions.

- Navigate to Taxes -> Tax Rules

- Click the ”Create Tax Rule” button

- Fill in the following fields

- Tax Code: Choose a previously created Tax Code from the

drop down box. - Tax Rate: Choose a previously created Tax Rate from the drop- down box.

- Tax Jurisdiction: Choose a previously created Tax Jurisdiction from the drop-down box.

In our example, this means combining Tax Code US, Tax Rate Orange County and Tax Jurisdiction Orange County.

4. Click save and close.

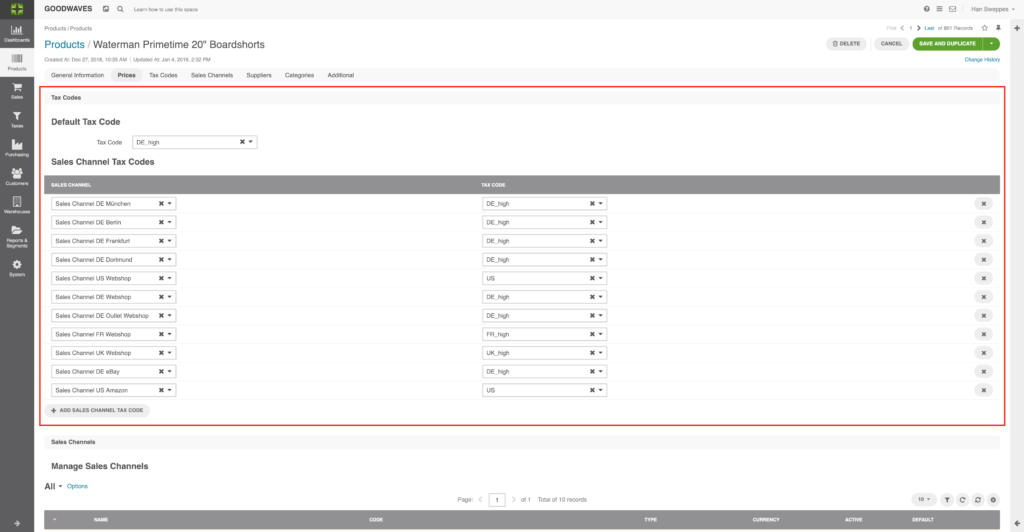

Assigning Tax Rules to Products

In order for tax rules to work, they should be assigned to products in certain sales channels.

- Navigate to products -> products

- Choose a product in the grid.

- Click the ”edit” button.

- Scroll to ”Tax Codes”

- Set a default Tax Code, that is used as a fallback

- Scroll to ”Sales Channel Tax Codes”

- Click the ”Add Sales Channel Tax Code” Button

- Select the Sales Channel the product is sold in

- Select the corresponding Tax Code

- Repeat for all Sales Channels the product is sold in

- Click ”Save and Close”

Products have now been assigned the apropiate Tax Codes